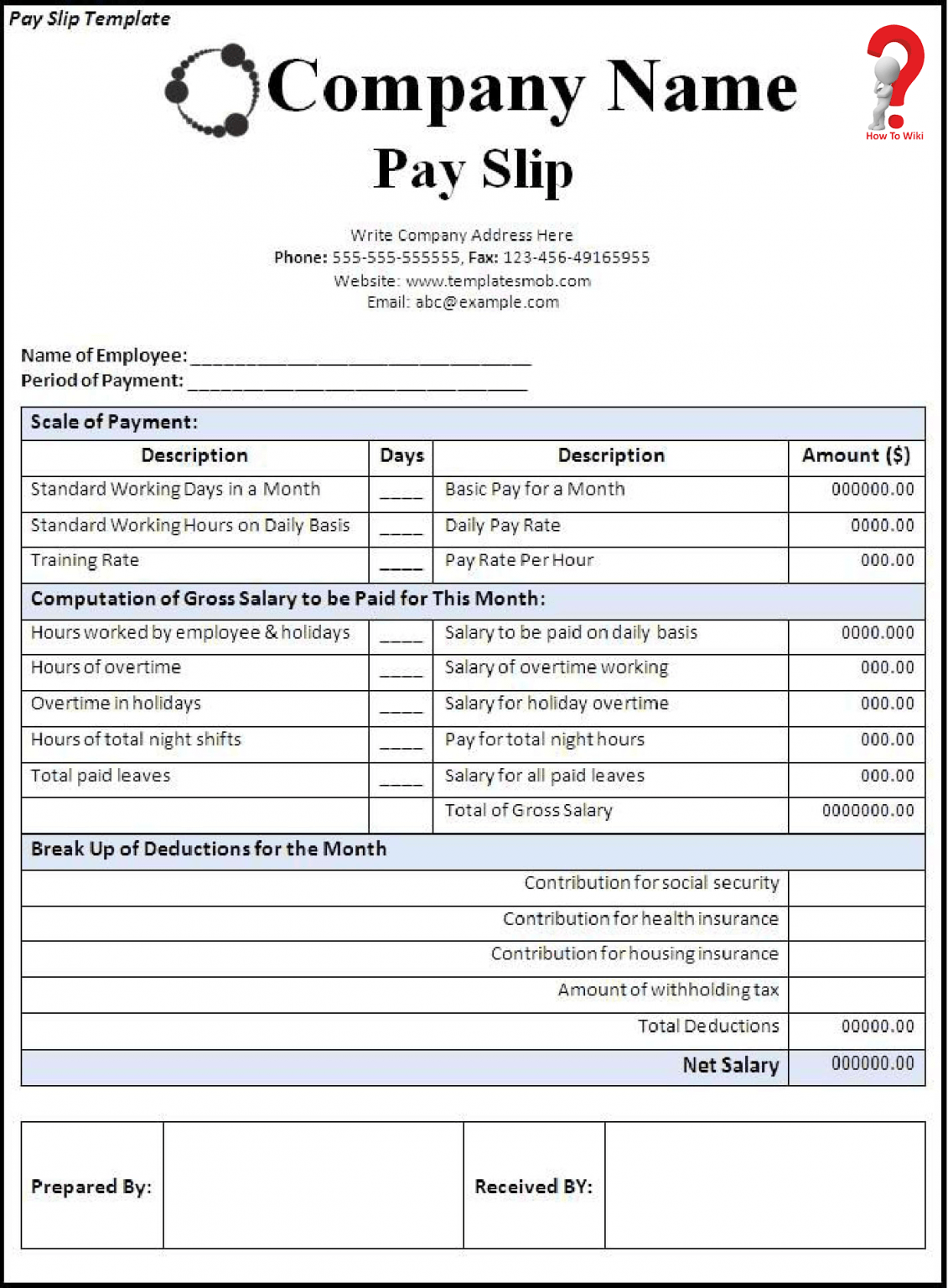

You will also be given a detailed breakdown of your base salary, benefits, bonuses, taxes and insurance contributions. Payslip middle section: Salary breakdown & Deductions ( Abrechnung) the company responsible for your health insurance)

To anyone who is not familiar with them, these breakdowns can be difficult to understand. Understanding your German payslipĮmployees in Germany will usually receive a monthly payslip ( Gehaltsabrechnung, Lohnabrechnung or Verdienstabrechnung) from their employer, detailing their salary, social security contributions and taxation. Your net salary, bonuses and benefits in kind all add up to equal your total net income.

by an international company), you may be offered an even more generous remuneration package: some expats are offered money to cover the cost of relocation, private health insurance, short-term accommodation or school fees for their children. Note that these “benefits in kind” ( geldwerter Vorteil) are also subject to income tax. Benefits can also include company cars, computers or mobile phones. Some employers in Germany also offer additional remuneration in the form of “13th-month”, summer or Christmas salaries, commission and performance-based bonuses.

To get a better idea of your net income, you can use a salary calculator. For example, if your gross monthly salary is 3.000 euros, then after deductions you can expect to take home around 1.950 euros per month. Calculating your net German salaryĪltogether, income taxes and social security contributions will take up around 35% of your gross salary.

Make sure you take into account the fairly big difference between gross and net income during any salary negotiations. If you are discussing salary with your employer, this will always be in terms of gross salary.

0 kommentar(er)

0 kommentar(er)